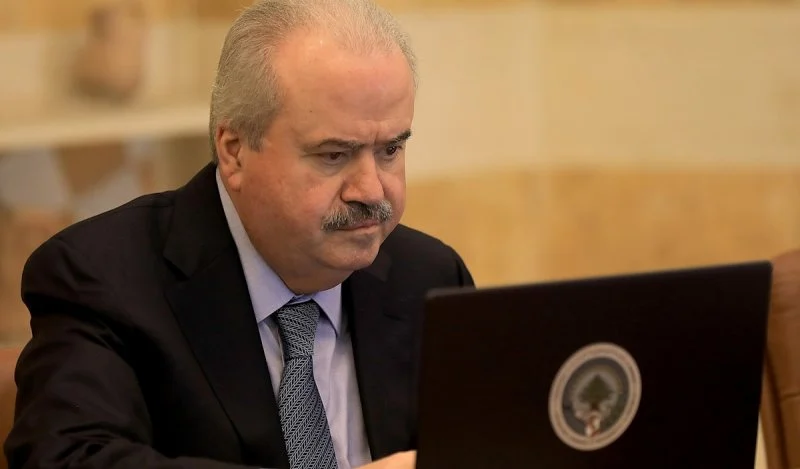

Minister of Finance, Yassin Jaber, announced the issuance of a decision to cancel Decision No. “768/1” issued on December 22, 2022. This repealed decision relates to the details of the implementation of Article 46 of Law No. 10, issued on November 15, 2022, and effective by law (the General Budget Law for the year 2022), specifically aspects related to methods of paying the financial stamp duty.

Accordingly, the Ministry of Finance announced in a statement, demanding that all companies working with it under contracts to collect taxes and fees, stop collecting the financial stamp duty using the form known as “(ص14)”, starting from January 1, 2026.

In addition, Minister Jaber issued an explanatory note regarding the collection of financial stamp duty due on invoices and receipts, including electronic invoices and receipts, with regard to taxpayers who are licensed to use a marking machine. The memorandum clarified that the payment of financial stamp duty through a licensed marking machine is considered a legally acceptable procedure, provided that the documents include the required data. This clarification comes in implementation of the provisions of the Financial Stamp Duty Law and current legislation, especially those related to the issuance of electronic invoices and receipts.

This clarification aims to achieve uniformity in legal application, facilitate procedures, and keep pace with the trend towards electronic invoicing and transactions, in order to ensure tax compliance and facilitate procedures for taxpayers.

The statement indicated that those interested can view all relevant decisions and memoranda on this subject by visiting the website of the Ministry of Finance: www.finance.gov.lb.